Time to be in Capital Preservation mode; Regime remains Low Vol and Quality: PL Asset Management

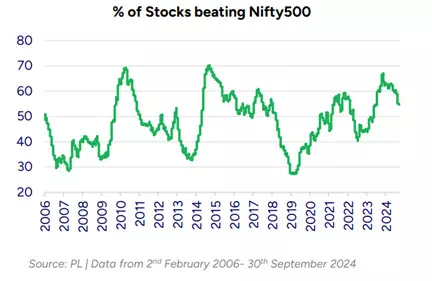

Valuations indicate extreme polarity in markets, over 50 per cent of stocks trading above 3-year average P/B. Percentage of stocks outperforming the Nifty 500 has reverted to 55 per cent from 65 per cent

Quantitative models showing performance summary of a stock

Hyderabad: PL Asset Management, the asset management arm of PL Capital- Prabhudas Lilladher, one of India’s most trusted financial services organisations, in its latest ‘PMS Strategy Updates and Insights’ report highlights that its cutting-edge quantitative models suggest that it is time to be in capital preservation and risk minimisation mode rather than focusing on return maximisation.

The report further adds that valuations indicate extreme polarity in equity markets, with over 50 per cent of stocks trading above their 3-year average P/B. In September, the percentage of stocks outperforming the Nifty 500 reverted to 55 per cent from 65 per cent, which suggests a narrowing market breadth. The broad-based rally appears to be reverting to a narrower and more polarised market outperformance, according to the report.

Amid this, investors seem to be prioritising safer, more stable investments in line with broader risk management strategies in a richly valued market environment.

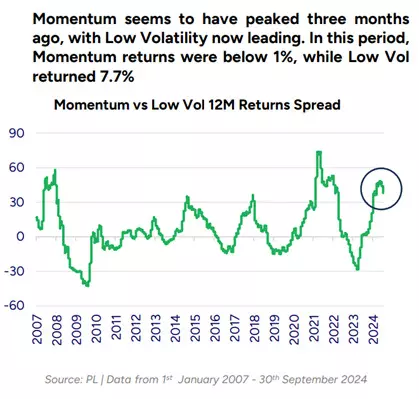

Over the past three months, the low volatility factor has surged by 7.73 per cent, significantly outperforming Momentum's 0.84 per cent and Value's 0.80 per cent, while Quality rose by 6.9 per cent. This performance indicates a "risk-off" sentiment with investors’ focus now on defensives. The shift towards Quality and Low Volatility in June and July foreshadowed the regime change in August, when these factors became the dominant influences.

In September, the Nifty Low-Volatility 50 generated returns of 2.93 per cent, while the Nifty 100 Equal Weight delivered 2.49 per cent, both exceeding the benchmark Nifty 50’s return of 2.28 per cent. In contrast, the Nifty High Beta 50 witnessed a decline of 0.44 per cent.

The Metal sector led the sector performance for September 2024 at 8.43 per cent, followed by consumer durable sector at 5.75 per cent and realty at 4.33 per cent.

According to PL Asset Management’s proprietary quant models, the broader equity markets are expensive. The Nifty 50's trailing P/E ratio stands at 24.3x, which is 9 per cent higher than its three-year average. In comparison, small-cap and mid-cap indices have trailing P/E ratios of 33.5x and 45.1x, reflecting premiums of approximately 18 per cent and 34 per cent over their three-year averages.

Consequently, relative momentum across assets has positioned gold as a favoured asset class. Central bank gold purchases, rate cuts, and geopolitical uncertainties are all contributing to rising prices for the yellow metal.

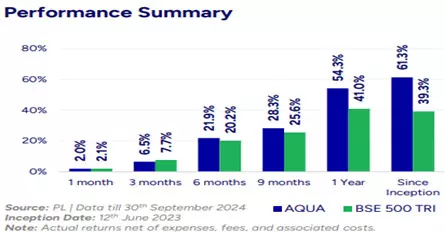

AQUA Performance

The timely shift from value-momentum factor exposure to quality-low volatility factor exposure has helped PL Asset Management’s flagship quantitative PMS AQUA generate risk-adjusted alpha returns. AQUA Fund has achieved an impressive return of 61.03 per cent since its June 2023 launch, against the benchmark BSE 500 TRI 39.3 per cent. AQUA has shifted allocation towards large and mid-cap stocks, now representing ~75 per cent of its portfolio. AQUA's portfolio has increased its allocation to non-cyclical sectors such as Healthcare, IT, Consumer Staples, and Consumer Discretionary, which are now approximately ~70 per cent of the total portfolio.

Additionally, AQUA now has a 10 per cent position in defensive financials, strengthening its ability to manage volatility effectively.

AQUA is India’s pioneering style-adaptive and style-agnostic strategy, engineered for alpha generation across market cycles. In over a year since inception AQUA has exceeded the INR 450 crore AUM (Assets Under Management) mark and consistently ranks among India’s top-performing Flexicap PMS and mutual funds.

Siddharth Vora, Head - Quant Investment Strategies & Fund Manager, PL Asset Management Executive Director, PL Capital- Prabhudas Lilladher said, “In August, we had strategically rebalanced the AQUA portfolio, adopting a quality & low-volatility-focused approach in response to growing market uncertainty. This ensured that the portfolio remained resilient and well-positioned to capitalise on opportunities in a volatile market environment. We have completely exited Industrials. AQUA strategy remains committed to seeking alpha through all market cycles. Despite a more defensive stance now, we remain focused on delivering superior risk-adjusted returns over the medium to long term.”